If you are in the market for a new credit card, then it’s no surprise that a 0% APR credit card is appealing to you.

In fact, a credit card with no interest is appealing to people who aren’t shopping for credit cards. Who doesn’t want the ability to borrow money at no cost?

It isn’t all that difficult to find a credit card that offers 0% APR. In fact, these credit cards are more prevalent today than they have ever been. These cards are easy to find and easy to obtain. Before you go out and sign up for the dream card, it is important to make sure you understand how these cards work.

Having a 0% APR credit card means that you pay only for what you have purchased. You can carry a balance for a few months without incurring any interest charge. Those cards with interest rates begin charging interest once the balance is carried past the grace period. With a 0% card, these interest charges do not occur.

Advantages

There are many advantages to having a credit card with a 0% APR. One of the biggest benefits provided by these kinds of cards is the reduction, and sometimes elimination, of credit card debt. One of the major causes of credit card debt is the amount of interest charged each month. In some cases, paying the minimum payment for a credit card barely covers the interest each month, if it covers it at all. Your credit card balance can increase every month, even if you make no additional purchases, if you only pay the minimum payment.

A credit card that does not have an interest charge does not create this problem. If you do not accrue new charges on the card each month, it is more likely that you will pay off a 0% APR credit card than it is that you will pay off a credit card that has an interest rate.

Zero percent APR credit cards are great for people who are just beginning to build their credit. It allows beginners to learn how to use the credit card and pay the balance each month without receiving a penalty.

Attached Strings

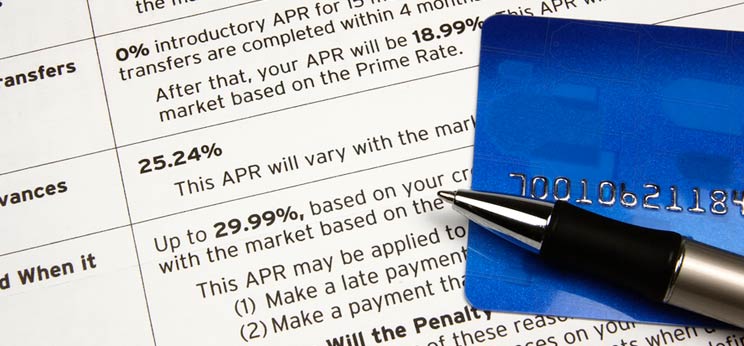

Cards with a 0% APR aren’t entirely free. As many benefits as there are with 0% APR credit cards, there are some strings attached depending on the card you receive. Some credit cards only offer 0% APR for a specific period of time. This can last anywhere from six months to eighteen months depending on the lender. Once this introductory period ends, the APR will increase dramatically. This often happens without any warning from the creditor.

There are some cards that only use the 0% APR rate to apply to balance transfers. This means that charges that are incurred when you use the card for purchases do not receive the 0% interest rate. Instead, these charges are affected by the normal APR for the card.

In some cases, there is an annual fee associated with 0% APR credit cards. Some creditors deem this as a privilege and charge a fee for that privilege. Depending on the amount of the annual fee, you could end up paying an amount comparable to what you would pay if there were variable interest rates.

Ultimately, the creditor receives something from the deal, whether it is in the form of an annual fee or a higher interest rate later on.

Choosing a Card

Since different creditors have different terms for 0% APR credit cards, the best thing to do is shop around for a card. Do a little research to find out what each creditor offers. This includes the length of the introductory rate and the types of charges the rate applies to. It is also important to note any kind of annual or membership fee associated with the credit card.

The best kind of 0% APR credit card to choose is one that offers the introductory rate for at least six months. The ideal card applies the rate to all credit card charges and does not charge an annual or membership fee for card users.

If you are shopping for a card that offers 0% APR on balance transfers, make sure to find out any fee associated with the balance transfer itself. There are some credit cards that do not charge interest on the balance transfer as long as it is held on the card; however, there could be a fee as high as 3% of the transfer amount. In some cases, there is no mention of this fee in the fine print of the credit card agreement. You could find yourself paying hundreds of dollars to transfer the fee to a card that does not charge interest.

The best thing to do to avoid a fee associated with a balance transfer is to ask the credit card issuer before accepting the offer.

Using a 0% APR Card Wisely

Credit cards companies hope that instead of paying off balances, users will carry the balance past the introductory period. This way, the balance is subject to the variable interest rate once the 0% rate has expired. If there is a high balance at this time, you could notice your monthly payment increasingly significantly. Not only that, you will find that most of the money you pay on your credit card each month goes toward interest rather than the balance of the credit card.

When using a card for a balance transfer, it is best not to apply any additional charges to the card. Credit card handler’s process payments in a way that applies payment to balances with the lowest rate first. Until you pay off the balance transfer, other charges do not get paid and they will incur the variable interest rate. You end up paying more over a longer period of time.

To use your 0% APR credit card wisely, you need to thoroughly understand the terms and conditions of the interest rate. To take advantage of the interest rate, or lack thereof, use your credit card in a way that is not subject to interest accrual.

Article Source: https://EzineArticles.com/expert/Gerard_Heitz/49114

I need oportunity credit cards