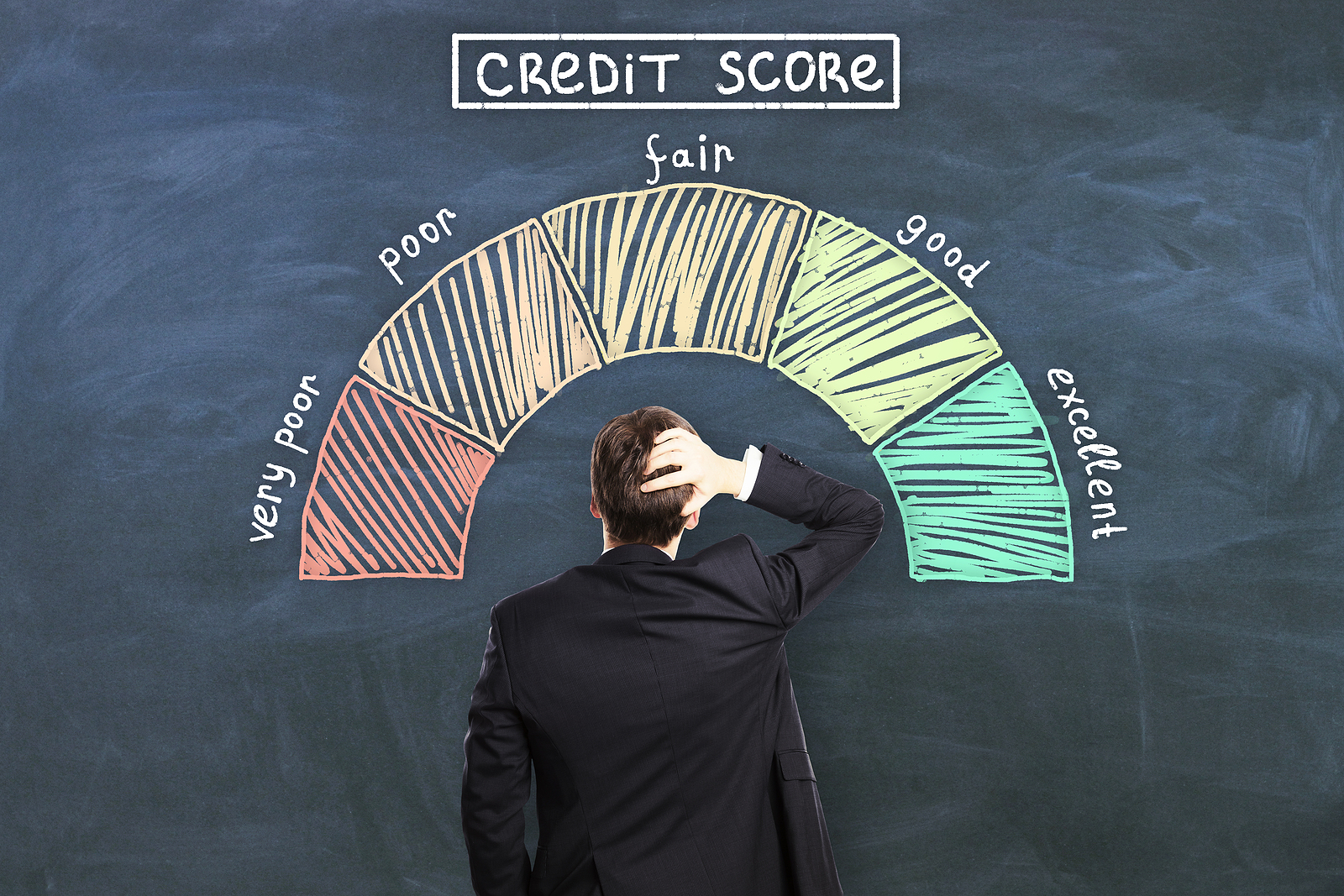

In the United States, your credit score and report are major factors in determining your interest rate on auto loans and home loans. They also affect what type of loan product you can get. If the score’s too low, you may not be able to obtain a mortgage unless you apply for a “hard money loan” and are willing to pay high interest rates. If the score is less than 620, you may have to get an FHA loan with high fees. That’s not an ideal situation. So, what can you do to improve your score?

Know Your Credit Score

First of all, you have to know what your score is. There are three credit repositories (Experian, Equifax, and TransUnion), and some creditors may only report data to one or two of them. That inconsistency may affect an individual’s score, so it’s good to check each one for inaccurate information at least once a year. If you find anything incorrect, contact the lender to dispute the charge.

Mortgage lenders typically look at reports from two or three of the credit bureaus. If they look at two, they’ll use the lowest score for qualifying purposes. If they look at three, they’ll use the middle score. A high credit score can enable you to obtain a better interest rate and perhaps qualify for a conventional loan with fewer fees than an FHA loan.

You can request a free report from each of the three repositories once a year at annualcreditreport.com. Unfortunately, you have to pay to receive the credit score and enroll in a monthly reporting program. However, you can pay, register, and immediately cancel so that you don’t incur any additional monthly fees.

Nonexistent Credit History or No Active Credit Cards

Suppose you always pay cash, so you have no credit score. In that case, there are a couple of free services (Experian Boost and UltraFico) available to you. These two companies collect banking information and report it to the bureaus. This allows you to build a credit score based on phone, utility, and other regularly scheduled payments. The amount of available funds in a checking or savings account might also positively impact your score.

Once you know your score, how do you improve it? If you’ve had an eviction or foreclosure or defaulted on existing credit cards, that information will remain on your credit report for seven years; a bankruptcy stays for ten years. The good news is that the damage to the score lessens over time. But when it first happens, you may find yourself in the 300-500 range. Since the range of possible scores is 300-850, it will take some time to increase it to a more respectable level.

If your score is that low and you have no credit cards, you might not be able to get a traditional card. If that’s the case, one of the fastest ways to improve your score is by obtaining a “secured credit card.” You use the card the same way as a regular credit card, but you’re actually debiting an account you’ve previously funded. You’re using your own money, but a secure card’s payments appear on a credit report. Search the internet for “secure card” and read the reviews and features of ones that appeal to you. The higher your balance the better, and make sure to pay it back in full each month.

Established Credit Card User

The credit score algorithm favors a high credit line with less than 30% utilization. If you absolutely must charge more than that, try contacting the creditor and requesting a higher limit that keeps you under the golden 30% mark. It may be granted if you have a history of successful payments and sufficient income.

If that’s not successful, pay down the debt as much as you can. Remember, it’s the ratio between the total amount of credit and the total debt that’s important. The best scenario is to pay the entire outstanding bill each month. It doesn’t help your score to keep making small payments. Using the card and paying in full will reap the highest rewards.

You can also apply for another card. The initial check by the lender might temporarily lower your score, but the additional available credit should help. Research the cards and find one with points or rebates that might benefit you.

Finally, check with banks about the possibility of obtaining a personal loan to pay off your credit card debt. If the loan interest rate is less than the interest rates on the credit cards, it might be worth it.

In summary, pay attention to your credit report and score. If you don’t have a score, think about using one or more of these steps to develop a credit history. You never know when an emergency or unusual circumstance might require you to apply for credit.