Credit card debt is a pervasive issue in the United States, affecting millions of households across various states. While some regions manage to keep their debt levels relatively low, others struggle with soaring balances that can hinder economic stability and personal financial health. This article delves into the U.S. states grappling with significant credit card debt issues, exploring the contributing factors and the broader implications for residents and policymakers.

Overview of U.S. States with High Credit Card Debt

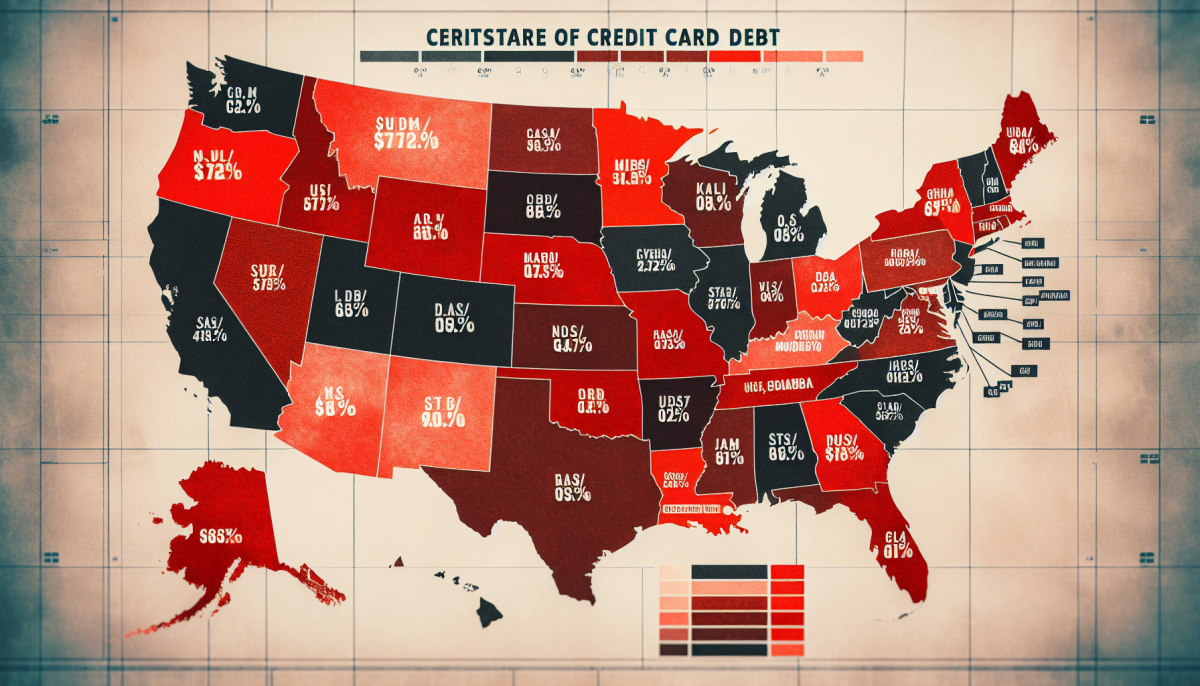

Several U.S. states stand out for their exceptionally high levels of credit card debt, reflecting broader economic and social challenges. States such as Alaska, Connecticut, and Virginia consistently rank at the top when it comes to average credit card debt per household. For instance, Alaska often leads the pack with an average credit card debt exceeding $8,000 per household, significantly higher than the national average. This trend is alarming, given the potential for long-term financial strain and decreased consumer spending.

Another state facing similar issues is New Jersey. With its higher cost of living and substantial tax burden, residents often turn to credit cards to manage everyday expenses. The average credit card debt per household in New Jersey hovers around $7,800, making it one of the highest in the country. Such elevated debt levels can have cascading effects, including increased default rates and a higher number of bankruptcy filings.

Texas is another state where credit card debt is a pronounced issue. Despite a booming economy and a low unemployment rate, many Texans are burdened with significant credit card balances. The average household debt in Texas is around $7,700, which, combined with relatively low median incomes in some parts of the state, exacerbates the financial strain on residents. It’s crucial to understand the underlying factors contributing to these high debt levels to address the root causes effectively.

Factors Contributing to Elevated Debt Levels

Several factors contribute to the high levels of credit card debt observed in these states. One primary factor is the high cost of living, which forces many individuals to rely on credit to cover essential expenses. In states like New Jersey and Connecticut, the cost of housing, healthcare, and education is significantly higher than the national average. This financial pressure often leads to increased credit card usage as residents try to bridge the gap between their income and expenses.

Another contributing factor is wage stagnation. While the cost of living has risen steadily over the years, wages have not kept pace in many regions. This income-expenditure mismatch forces residents to depend more on credit cards to maintain their standard of living. States like Texas, despite their robust economic growth, still face pockets of wage stagnation, particularly in rural areas. This discrepancy can lead to increased reliance on credit, thereby inflating debt levels.

Financial literacy and education also play a crucial role in managing credit card debt. In states where residents have limited access to financial education, the propensity to misuse credit cards is higher. Lack of understanding about interest rates, minimum payments, and credit scores can lead to poor financial decisions, exacerbating the debt problem. Efforts to improve financial literacy through community programs and education initiatives could be instrumental in mitigating these issues over the long term.

Addressing the issue of credit card debt requires a multifaceted approach, involving both individual action and systemic change. States with high levels of credit card debt need to consider policies that alleviate the financial pressures on residents, whether through affordable housing initiatives, wage growth strategies, or enhanced financial education programs. By tackling the root causes of elevated debt levels, it is possible to foster a more financially stable and prosperous environment for all residents.