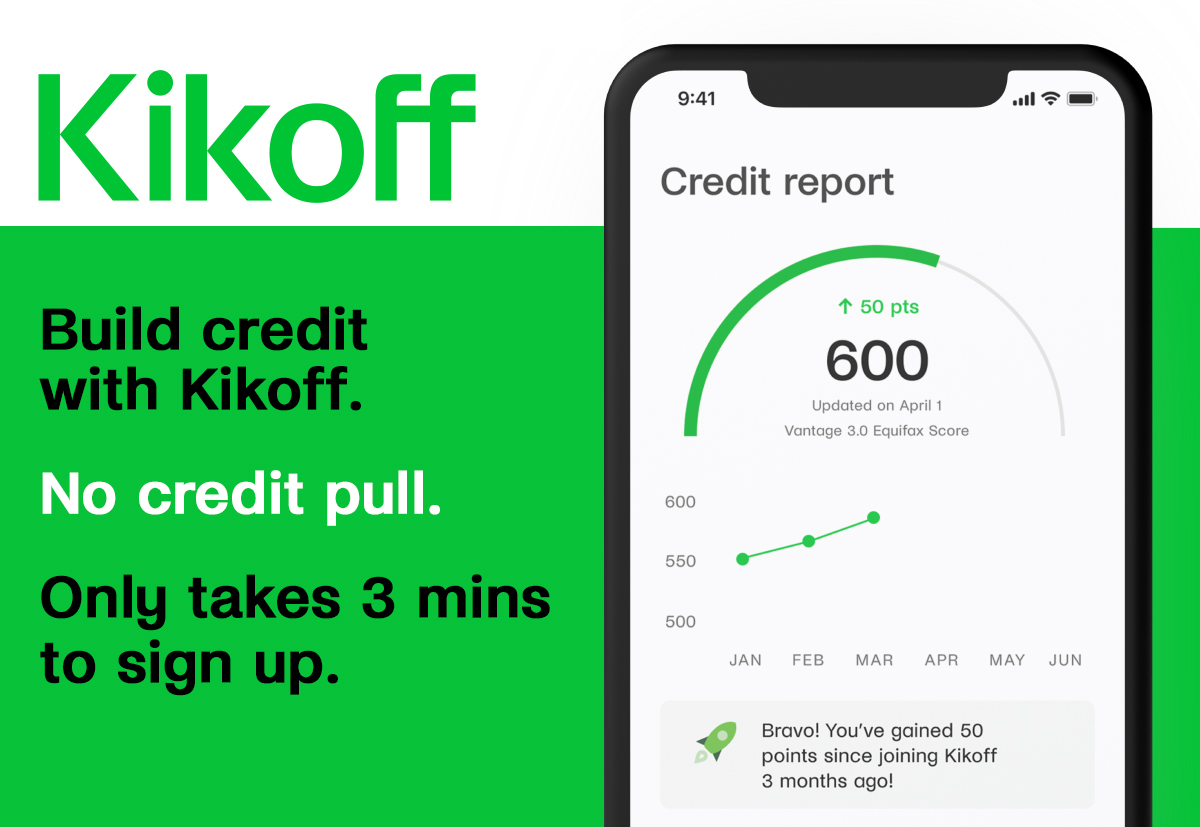

Credit Spotlight: Kikoff

Continue Reading »

We've just made it easier than ever to check your credit score. If you can’t remember the last time you checked your credit score, take the time to request it here. It'll give you a better idea of where you stand financially, as well as let you know if need to take action to improve it. Your credit score is a numeric representation of your credit history. The higher your score, the better your credit history. This number ranges from 300 to 850. What is your credit score? Check it now.

Credit building on your terms.

You decide how much to spend and how many months of payment history to build. There’s no minimum time commitment – you can pay your balance in full at any time.

Grow payment history, guaranteed.

With AutoPay we automatically settle your balance on time, every month. This guarantees you build your payment history – and your credit.

Reach your financial goals.

Every month we report your payments to the major credit bureaus. Grow your credit to get that apartment lease, car loan, those lower interest rates.

Updated for: Tue 24 Feb 2026

Make note of what you’re seeing: It’s critical that you double check the data to ensure that it’s inaccurate. From there, make a copy of your credit report and write down exactly what’s wrong. You’ll need this information in the future.

Contact the organized that provided the information to the credit bureau and the credit bureau itself: Both parties are responsible for making things right as outlined by the Fair Credit Reporting Act. Inform them as to what’s wrong as soon as possible.

Provide all the necessary information: Credit bureaus are required by law to investigate the information in question within 30 days. In addition to providing a copy of the credit report to support your stance, you should clearly identify the disputed item, add facts as necessary, and request that it’s corrected or deleted in a timely manner.

From there, wait for a response from the credit bureau. If they state that the issue will be taken care of, continue to regularly check your credit report to ensure that it is.

The Federal Trade Commission is well aware that this is a problem, which is why it provides information on its website about how to dispute credit report errors.

It’s frustrating to find an error on your credit report, as it forces you to spend time disputing the information and making things right. However, it’s better to do this than to simply hope for the best. Your credit report is a picture into your financial health. You want it to be 100 percent accurate at all times. Should you come across an error, take the steps above to rectify the situation as soon as possible.

In the identity section, everything should match information that pertains to you. No one else. While you’re reviewing for these inaccuracies, check your Social Security number to ensure that it also checks out. And when it comes to addresses, there shouldn’t be anything on the list that you don’t recognize. For example, if it says you’ve lived in Alaska for five years but have never even visited the state, that’s a problem.

2. Credit History ErrorsAs the years go by, your credit history will continue to grow. While you expect it to remain accurate, this doesn’t always happen. Closely read through this section of your credit report to check for errors. Do you see accounts that you never opened? How about late payments that you actually made on time? What about open accounts that are displayed as closed?

If you find that an account was opened without your consent, there’s a good chance you’ve been the victim of identity theft.

3. Public Record ErrorsWhile this section isn’t typically as expansive as your credit history, it could include things such as a bankruptcy filing and tax liens. You probably won’t find any errors here, but it could happen. It’s worth a closer look just to be sure. The last thing you need is a bankruptcy showing up in the public record section when you never filed.

4. Inquiry PermissionHard credit inquiries can ding your credit score, so too many of these are a bad idea. It’s okay to apply for a loan that’ll result in a hard inquiry, you just don’t want to do this too often. If you find a hard inquiry that you didn’t consent to, find out why.

Tip: hard inquiries will remain on your credit report for roughly two years. After that, they drop off and are never to be seen again.

If you don’t know your credit score, you could find yourself applying for loan and credit offers that you don’t qualify for. For instance, if a particular credit card requires a very good or exceptional score, but you’re in the fair range, your chance of approval is extremely low.

Here’s something else to consider: too many credit inquiries in a short period of time can have a negative impact on your score. For this reason, you don’t want to continually apply for offers that you won’t qualify for.

Knowing your credit score will help you better plan the search and application process.

About Our Ratings

We are not a lender. Instead, we partner with lenders and credit card banks that are willing to provide our audience with credit and loan products. We have no control over rates, fees, and other terms and conditions. This is determined by your lender, based on a variety of factors. We never make credit and/or loan offers and we don’t broker online loans and/or lines of credit. Also, we don’t make credit decisions. This website will submit the information provided by you to partner lenders and/or credit card banks. However, this does not guarantee that you will receive approval for any type of loan or line of credit. The operator of this website is not a broker, agent, or representative of any lender or credit line provider.

Advertiser Disclosure

We have agreements with our credit card banks and lending partners that allow us to receive compensation when someone applies or gets endorsed for a loan, credit card, or any other type of financial product throughout our website. Even with this agreement in place, all of the provided information is accurate, to the best of our knowledge, and provided in a neutral manner. Compensation may impact the products we review and survey, as well as their position on our website. We strive to provide a comprehensive guide to our users, but realize that our website does not include every product from every financial institution.

Office Location : Attn: LeadDemand.com - 3350 Shelby St. Suite 200 #1015 Ontario, CA 91764 Contact Us : support@applynowcredit.com Phone Support Customer Service

Copyright © 2026 | ApplyNowCredit.com | All Rights Reserved | Choose the Right Credit Card in seconds